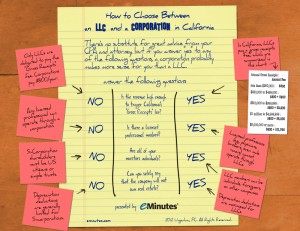

How to Choose Between an LLC and a Corporation in California

There’s so much written on the web about choosing between an LLC and a corporation. Far too often, entrepreneurs are unaware that LLCs and corporations are very different. Although virtually the same from a liability protection standpoint, LLCs and corporations are extremely different from a tax standpoint.

We’ve attempted to make the choice easier with this info-graphic.

An entrepreneur should put together a team, consisting of a lawyer and a CPA to help evaluate what form of entity makes the most sense. The following are some basic guidelines:

- We use LLCs as the entity of last resort, because of the extreme junk fees – called the “Gross Receipts fee” that apply to LLCs (but not to corporations) in California.

- In California, the initial $800 franchise tax is waived for corporations, but not for LLCs.

- Licensed professionals cannot operate through LLCs in California

- LLCs are best where the company will own real estate.

- S-Corporations are best except where the corporation will have shareholders who are foreigners or other companies.