How to choose between a corporation and a LLC

Limited liability companies (LLCs) and corporations both provide the same liability protection. The difference between LLCs and corporations is a tax issue. In California and New York, LLCs pay fees that corporations do not have to pay, and those fees can be substantial. Four considerations when selecting the best type of company to form are: (1) the high fees that LLCs must pay, (2) is a license or profession involved, (3) will there be foreign investors, and (4) will the company own real estate. In this article, we will address these four considerations.

Consider the fees. LLCs are far more expensive to operate and form than corporations, so we suggest LLCs as an entity of last resort, not the entity of first choice.

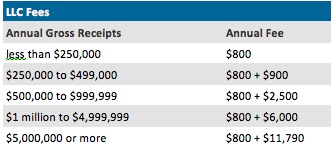

In California, corporations and LLCs both pay $800 per year as a “franchise tax”. LLCs, however, pay an additional fee called the “gross receipts” fee, which kicks in once the LLC has more than $250,000 in gross revenue. For a LLC with $1 million in annual gross revenue, a LLC would be obligated to pay $6,800. On the other hand, a corporation with $1 million in gross revenue, would only pay $800. The chart below describes the breakdown of the LLC gross receipts fee. To learn more about the LLC gross receipts fee, view Looking to Cut Costs? Start with your LLC.

New Yorkers are only slightly better off. In New York, LLCs (but not corporations) must pay a hefty fee (nearly $1800 in Manhattan) to publish notice of their existence. To learn more about New York’s publication requirement, view New York’s Irrational LLC Publication Requirements.

Licensed or professional businesses. In many states, certain types of businesses cannot operate as LLCs. California is the most extreme, as no business that is involved in a profession or requires a license may operate as a LLC. View our Crazy List of Businesses that may not operate as LLCs in California.

Are foreign investors involved? Although a “S” corporation might be the more desirable form of corporation, to be eligible to be taxed as a “S” corporation, only individuals (and some kinds of trusts) can be shareholders. This means that if there are foreigners or corporate investors involved in your venture, a LLC might be the better choice despite the high fees.

Will the company own real estate? Real estate investments are one of the few types of businesses where a LLC usually makes sense despite the high fees.